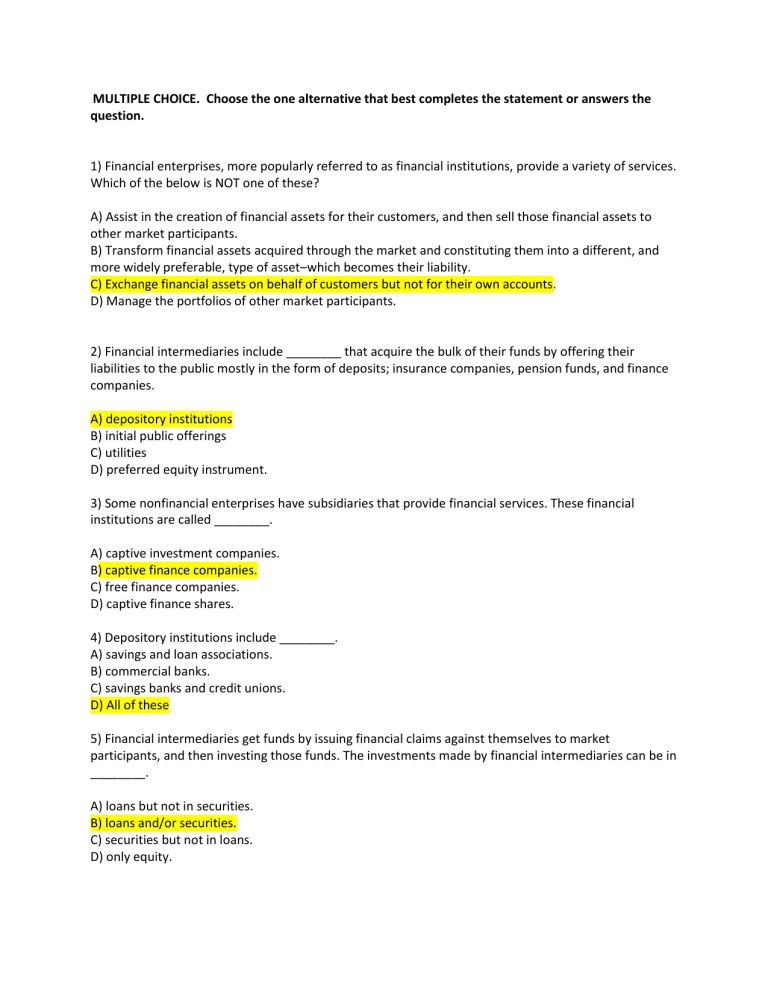

A investment bank b online bank. 16 43 The largest depository institution at the end of 2001 was A life insurance companies.

Depository Institution An Overview Sciencedirect Topics

In last remember that those who pay you interest give loan facilities business transaction and collect your money they are Depository.

. 1011 et seq commonly referred to as the McCarran-Ferguson Act remains the law of the United Statesb Mandatory insurance. For more information click here. They gave you loans.

The firm also has 72 billion in long-term debt and 56 billion in common equity. 15 purpose depository institution. Which of the following is not a depository institution.

Its balance sheet shows 32 billion in current li. The range of services offered by commercial banks depends on the size of the banks. Investment firm savings institution What is the effective yield the investor would expect if the tax rate of the investor is 30 the nominal yield offered on a taxable investment is 16.

See the answer Show transcribed image text Expert Answer 100 8 ratings The correct answer is option a. Types of Depository Institutions. Commercial bank Saving institution credit union and so on.

Year 1 January 5 Sold 16950. Commercial banks are forprofit and credit unions are notforprofit. A business that offers and sells financial services to people is ________.

4Government securities are considered default free risk free. Which of the following is a depository institution. The routine uses in this action will become effective on June 15 2022 unless the FDIC makes changes based on comments received.

The character reputation financial standing and ability of the. 2 the term depository holding company means a bank holding company as defined in section 1841 a of this title a. Iselarodas16 iselarodas16 03142018 Business College.

Operation of State law a State regulation of the business of insurance. The following are sufficient to afford reasonable assurance of successful 8 operation for the proposed institution and of compliance with the law. To date this includes larger participants in the following markets.

A a savings and loan association B a commercial bank C a credit union D a finance company Answer. Introduced in the 1930s following more than a decade of socially disruptive bank failures was based on an implicit. FinCEN is no longer accepting legacy reports.

Which of the following financial intermediaries is NOT a depository institution. A A life insurance company B A mutual savings bank C A pension fund D A finance company. Edelman Engines has 16 billion in total assets of which cash and equivalents total 120 million.

The following are the three main categories of depository institutions. Based on the expectations hypothesis of the term structure of interest rates if the slope of the term structure decreases this is most. NCNB consequently suffered a 180 million unrealized loss in its bond portfolio.

Written comments should be submitted on or before the routine uses effective date of June 15 2022. The primary assets of credit unions are. As of April 1 2013 financial institutions must use the new FinCEN reports which are available only electronically through the BSA E-Filing System.

A n is a depository institution that is onned by its deppositors aho are members of a common organization or association such as an accupation a religos group or a community a. A A life insurance company B A mutual savings bank C A pension fund D A finance company Answer. By March 16 1990 the 30-year GNMA yield was 995.

C state retirement funds. View the full answer. The main source of funding for these institutions is through deposits from customers.

2 Section 19 also provides that balances maintained by or on behalf of. Abilities of which the notes payable balance totals 084 billion. C life insurance company.

A part of the central banking system in the United States. 8 Questions Show answers. This action will become effective on May 16 2022.

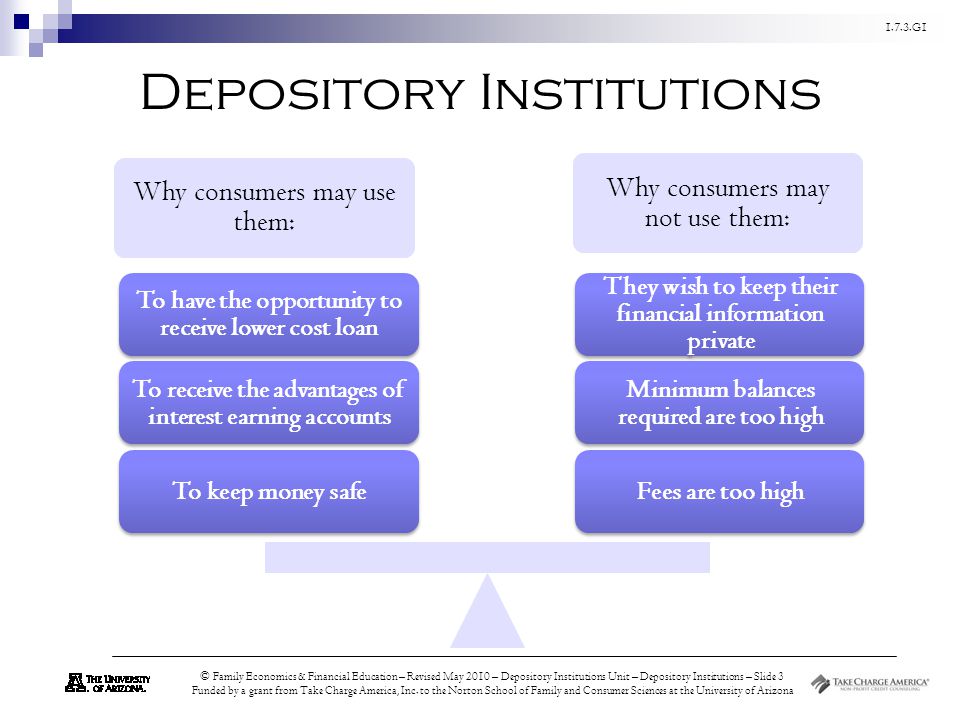

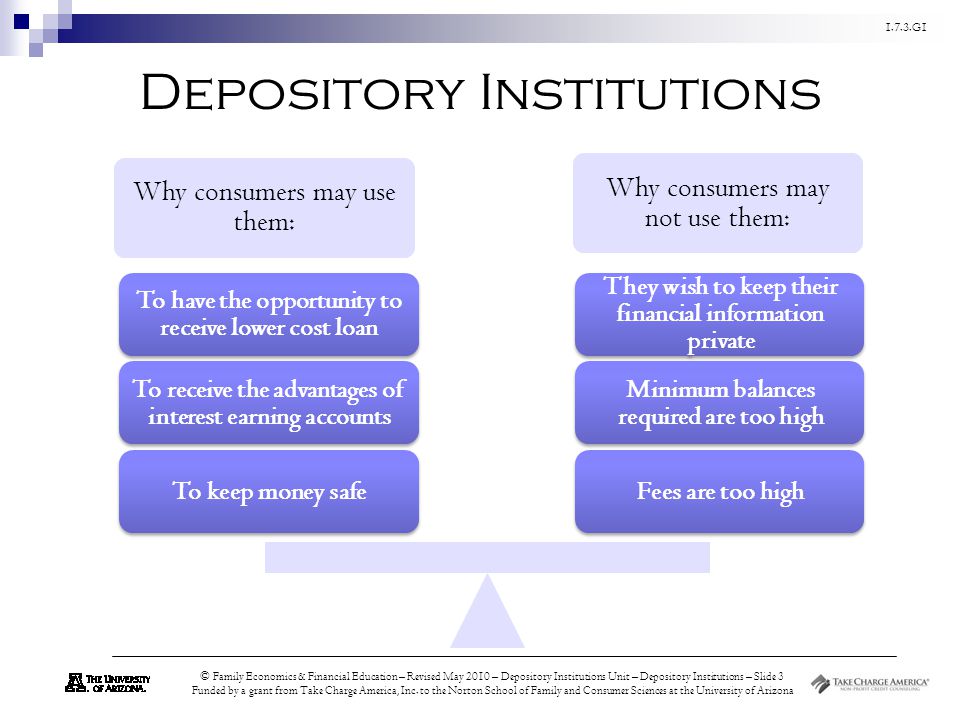

Business which offers multiple services in banking and finance. Previous Edition B. Posted on May 12 2022 by.

Regulation D which implements section 19 of the Act requires that a depository institution meet reserve requirements by holding cash in its vault or if vault cash is insufficient by maintaining a balance in an account at a Federal Reserve Bank Reserve Bank. They have 3 types of account for people who want to deposit their money. Insurance company e mutual fund 17.

Which of the following is a depository-type of financial institution. As of year end 1989 the yield on 30-year GNMAs was 949. Money must remain in this financial tool for a specific period of time to earn more interest but you pay a penalty if you withdraw sooner.

D 44 The value of assets held by commercial banks in 2001 was 67 trillion dollars making commercial banks the. 1 the term depository institution means a commercial bank a savings bank a trust company a savings and loan association a building and loan association a homestead association a cooperative bank an industrial bank or a credit union. The most common depository institution that offers financial services to both consumers and businesses is__________.

Commercial banks are for-profit organizations and generally owned by private investors. The Act entitled An Act to express the intent of Congress with reference to the regulation of the business of insurance and approved March 9 1945 15 USC. Commercial banks typically pay.

Full-service institution that offers a wide variety of services including checking and savings accounts loans credit cards investments and financial counseling. 4 Which of the following is a depository institution. Or 16 b Conflict with any provision of this subtitle.

A key difference between commercial banks and credit unions is that. Sun Corporation completed the following transactions during its first two years of operation. D none of the above.

Find an answer to your question which of the following is a depository financial institution. The three main types of depository institutions are credit unions savings institutions and commercial banks. FinCEN Announces 140 Million Civil Money Penalty against USAA Federal Savings Bank for Violations of the.

Depository Institutions Ppt Video Online Download

0 Comments